What Exactly Is a Salvage Title?

If you’ve ever browsed used cars online, you’ve probably come across listings marked with a salvage title—usually with a tempting price tag that looks too good to be true. But what does “salvage title” actually mean?

A salvage title is a special designation assigned to vehicles that have been declared a total loss by an insurance company after an accident, flood, theft recovery, or other major damage. While the low price may attract budget-conscious buyers, the risks can be significant—ranging from unseen mechanical problems to difficulty getting insurance.

This guide breaks down everything you need to know about a salvage title, how the system works, why cars receive this status, and whether buying one is ever a smart financial move.

What Does Salvage Title Mean?

A salvage title means the vehicle has been declared a total loss by an insurance company due to severe damage or loss in value. The cost to repair the car exceeds a certain percentage (usually 60%–90%) of its pre-damage value. The state then reissues the car’s title with a salvage designation, indicating the vehicle cannot be legally driven until rebuilt and inspected.

Common reasons a car gets a salvage title:

- Major collision damage

- Flood damage

- Fire damage

- Hail or storm destruction

- Theft recovery with severe parts loss

- Vandalism

- Airbag deployment in some states

- High repair estimate relative to vehicle value

A salvage title doesn’t always mean the vehicle is junk. Sometimes, older but previously reliable cars are totaled simply because parts and labor cost more than their value—yet they remain mechanically sound.

How Does a Car Become a Salvage Title Vehicle?

Here’s the typical process:

Step 1: The incident occurs

Accident, flood, fire, or theft triggers an insurance claim.

Step 2: Damage evaluation

The insurance company calculates:

- The car’s actual cash value (ACV)

- The repair cost estimate

- The total loss threshold (varies by state)

If repair costs exceed the threshold, it’s declared a total loss.

Step 3: Vehicle receives a salvage title

Insurance companies file paperwork with the DMV, changing the title status.

Step 4: Vehicle is repaired, auctioned, or scrapped

Salvage vehicles typically end up at:

- Insurance auctions

- Rebuilder lots

- Export buyers

- Junkyards

Step 5: Car may qualify for a rebuilt title

Only after passing state inspections can it be registered and legally driven again.

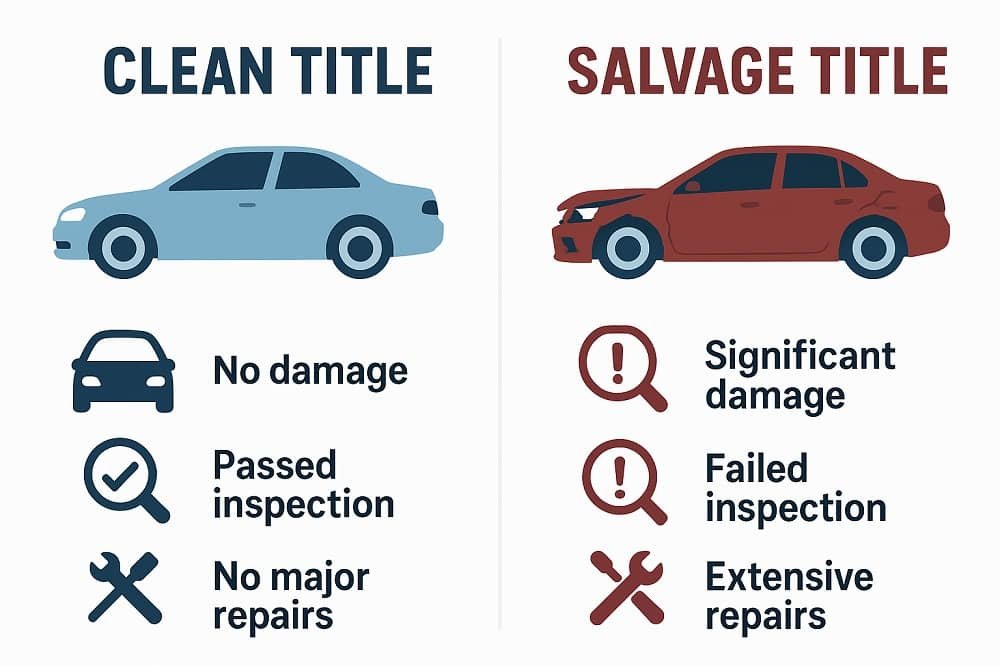

Salvage Title vs. Rebuilt Title: What’s the Difference?

Buyers often confuse the two. Here’s a quick comparison:

| Title Type | Meaning | Can You Drive It? |

| Salvage Title | Totaled vehicle, unrepaired | ❌ No |

| Rebuilt Title | Salvage car repaired + inspected | ✔️ Yes |

A salvage title vehicle cannot legally be driven.

A rebuilt title vehicle is repaired, inspected, and road-legal again, but its history remains permanently visible.

Why Do Insurance Companies Total a Car Even if Damage Seems Minimal?

Many people are surprised when cars with cosmetic damage receive salvage titles. Reasons include:

1. High labor and parts costs

Modern vehicles use expensive electronics, sensors, and ADAS components.

2. The vehicle’s age and depreciation

A 10-year-old sedan worth $5,000 can be totaled by $3,500 in damage.

3. Structural damage concerns

Bent frames or compromised crumple zones require specialized, costly repairs.

4. Safety and liability protections

Insurers often avoid repairing vehicles that could pose future risks.

5. State-specific total loss thresholds

Examples:

- Florida: 80%

- Minnesota: 70%

- Texas: 100% (must meet or exceed value)

Pros and Cons of Buying a Salvage Title Vehicle

Buying salvage isn’t always a bad idea—but you must understand both sides.

Pros

✔ Significant cost savings

Many salvage vehicles sell for 30–70% below market value.

✔ Good for parts

You can buy salvage cars to:

- Strip for high-demand parts

- Restore classics

- Build track cars

✔ Potential for bargain finds

Lightly damaged, theft-recovery, or vandalism-only salvage vehicles can be excellent deals.

Cons

❌ Hard to insure

Many carriers refuse full coverage for salvage or rebuilt vehicles.

❌ Financing difficulties

Banks rarely provide loans for salvage title cars.

❌ Unknown or hidden damage

Flood or frame damage can be nearly impossible to detect without expert inspection.

❌ Lower resale value

Even a perfectly repaired car may be worth 40% less.

❌ Safety risks

Airbag systems, frame integrity, or sensors may not work properly.

When Is It Worth Buying a Salvage Title Vehicle?

A salvage title may be worth considering if all these conditions are met:

- Damage is cosmetic, not structural

- You have access to affordable repair services

- The discount exceeds the cost of repairs + risk

- You plan to keep the car long-term (not resell)

- You understand insurance limitations

- The car passes a third-party pre-purchase inspection

Best salvage title situations:

- Theft recovery with minimal damage

- Vandalism (paint keying, broken windows)

- Minor cosmetic accident

- Hail damage that doesn’t affect driving

Worst salvage title situations:

- Flood damage (extremely risky)

- Fire damage

- Severe frame damage

- Airbag system explosion

How to Check if a Car Has a Salvage Title

Always verify the title before purchasing. Methods include:

✔ State DMV title records

Look for branding such as:

- SALVAGE

- TOTAL LOSS

- JUNK

- NON-REPAIRABLE

✔ Vehicle history reports

Use:

- Carfax

- AutoCheck

- VINCheck (from NICB)

✔ Auction history

Many salvage vehicles appear on:

- Copart

- IAAI

- AutoBidMaster

These show original damage photos—extremely valuable for buyers.

How Salvage Titles Affect Insurance Coverage

Liability Insurance (usually allowed)

Most insurers provide minimum liability, because it covers other drivers.

Comprehensive & Collision (often denied)

Many carriers refuse full coverage for salvage title cars due to:

- Uncertain repair quality

- Safety system concerns

- Difficulties in calculating ACV

Rebuilt title coverage

Easier to insure, but expect:

- Higher premiums

- Lower payout if totaled again

How Much Does a Salvage Title Affect Value?

A salvage title reduces a vehicle’s market value by 40–75% depending on:

- Damage severity

- Brand reputation

- Vehicle age

- Repair quality

Example:

If a Toyota Camry is worth $15,000 clean title:

- Rebuilt title: $9,000–$11,000

- Salvage title: $4,500–$7,000

Salvage Title Laws: What Varies by State?

Each state has its own rules. Differences include:

- Total loss thresholds

- Inspection requirements

- Terminology (some states use “junk” vs. “salvage”)

- Whether branding is removable (never in the U.S.)

Always check local DMV guidelines.

How to Convert a Salvage Title to a Rebuilt Title

Not all states allow this, but when they do, the process looks like this:

1. Repair the vehicle using licensed professionals

Keep receipts for all parts and labor.

2. Apply for a rebuilt title inspection

This includes:

- Safety checks

- Emissions tests

- Anti-theft verification

3. Submit documentation

DMV requires:

- Salvage title

- Repair invoices

- Inspection reports

- Photographs

4. Receive rebuilt or “prior salvage” title

The car is now drivable—but the salvage history remains permanent.

Salvage Title & Resale Value: What Buyers Need to Know

Salvage title cars are more difficult to sell. Expect:

- Low buyer confidence

- Difficulty passing pre-sale inspections

- Limited dealer trade-in options

- Lower appraisal values

However, rebuilt titles sell easier than salvage titles because the car is road-eligible.

Should You Sell or Trade In a Salvage Title Car?

Dealers typically avoid salvage vehicles due to liability risks. You’ll get:

- Higher profit selling privately

- Lowest offers when trading in

Platforms that accept salvage cars include:

- Local buyers

- Hobbyists

- Part-out specialists

- Salvage and export markets

FAQs About Salvage Titles

1. Is a salvage title bad?

Not necessarily, but it comes with risks such as low resale value, hidden damage, and limited insurance options.

2. Can you drive a salvage title car?

No. A salvage title car must be repaired and inspected before it can be driven.

3. Can a salvage title be insured?

Only with limited coverage. Rebuilt titles are easier to insure.

4. Are salvage cars safe?

They can be—but only if repaired by certified professionals and verified through inspection.

5. How much cheaper are salvage title cars?

Typically 40–70% less than clean-title vehicles.

6. Why are so many salvage title cars at auctions?

Insurance companies sell total-loss vehicles to recoup losses.

7. Is flood-damaged salvage worth buying?

Almost never. Flood damage creates long-term electrical and corrosion issues.

Final Thoughts: When Is Buying a Salvage Title Smart?

A salvage title car can be a money-saving opportunity, but only if:

- You understand the risks

- You’re able to assess repair quality

- The discount is larger than the risk

- You’re not planning to resale quickly

- You get the car thoroughly inspected

For most casual buyers, a rebuilt title is a safer middle ground. But for mechanically inclined buyers or those with access to cheap repairs, salvage title cars can provide excellent value.